Pharmaceutical Repackaging – A Growth Market in Patient – centric Healthcare

Pharmaceutical repackaging has become a growth market amidst an increasingly patient-centric healthcare market for a number of reasons: to fit with the dosage and formulation needs of different patient groups; to reduce treatment administration errors associated with doses in liquid form at the point of patient care; to eliminate residual quantities of addictive prescription medicines; to improve patient compliance by resizing or reformulating in more convenient dosages; or for improved convenience to the healthcare practitioner by changing the method of administering to a patient; and lastly but certainly not the least is the importance of reducing cost. In some cases, however, the market opportunities for repackaging are less clear. By conducting interviews and online surveys with the 4Ps (Patients, Providers – Drs., nurses etc., Payors – health insurance providers and Pharma – supplier of primary packaging material) of the healthcare sector, i3 Consult can achieve a 360o perspective on the pain points and opportunities for establishing a USP (unique selling point) in your pharma repackaging space.

i3 Consult can also solicit primary and secondary research to establish a predictive value of plastic bottles being used as packaging for your oral drugs distributed in bulk and prescription dose volumes to retail and mail order pharmacies and conduct a competitive analysis of other innovative packaging methods.

Although blister packaging is likely to maintain favorable growth based on its adaptability to unit-dose formats with expanded-label content, high visibility, and built-in track-and-trace features, there are other innovations which need evaluation to optimize the client’s market position and marketing mix (MM). For example, Dupont’s Surlyn® offering high patient visibility, significant weight and volume reduction as well as related pharmaceutical pouches are forecasted to expand in the pharma repackaging space and hence a feasibility study may need to be conducted around these opportunities.

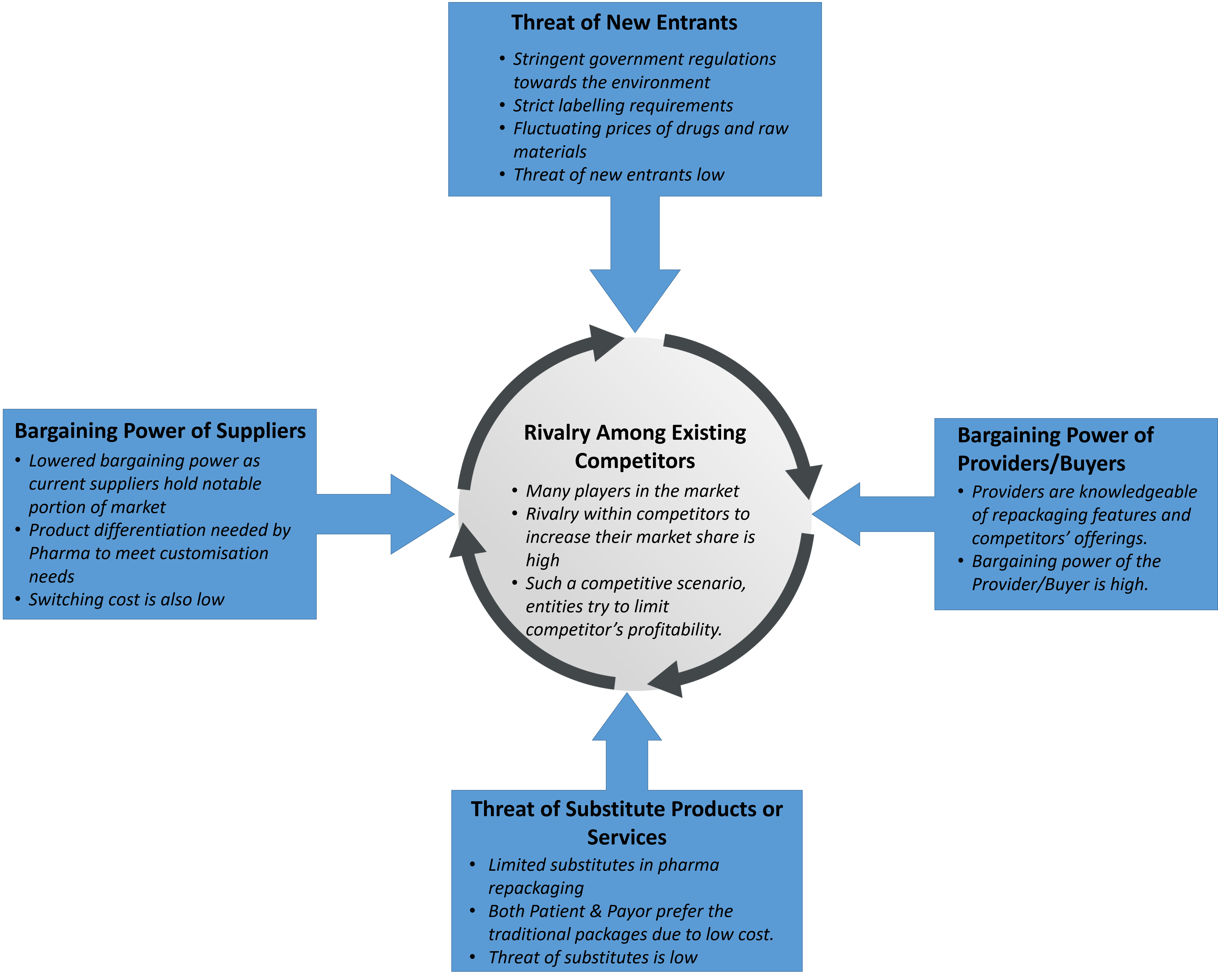

I3 Consult as part of its competitive landscape analysis can establish what product repackaging elements have become the essential part of the drug delivery system as well as the core elements of the MM.

In today’s patient centric healthcare market[1], Providers have found in-house dispensing as a new revenue stream as well as achieving greater compliance and outcomes. i3 Consult will establish for the client an optimal market position with in-house dispenser partners (selected Providers) and Pharma vendors. After conducting an in-depth value chain (figure 1) and competitive landscape (figure 2) analyses, a comprehensive road map will establish both the optimal MM and USP impacting on value-added service for Patients which in turn will distinguish the service and product among the client’s competition.

[1] Reference: www.i3consult.com/patient-journey-holistic-journey/

Figure 1: Value Chain Analysis

Figure 2: Porter’s Five Forces Analysis