At i3 Consult a new select range of capabilities has impacted on our core services. However we remain committed as ever before to our mantra of “i3” being our big three “i”s in our business model – Integrated Intelligence for the healthcare Industry and with this we continue to deliver great results for our healthcare, pharma and life science clients! . Building on this core service, we’ve added new ways to help clients access data, gain success critical insights, with the leverage of advanced analytics, design capabilities, and a range of game changing software solutions. With our core team of experts & our 200000+ network we empower clients to implement change, build capabilities and transform themselves in this competitive healthcare business space.

Featured Practices & Capabilities

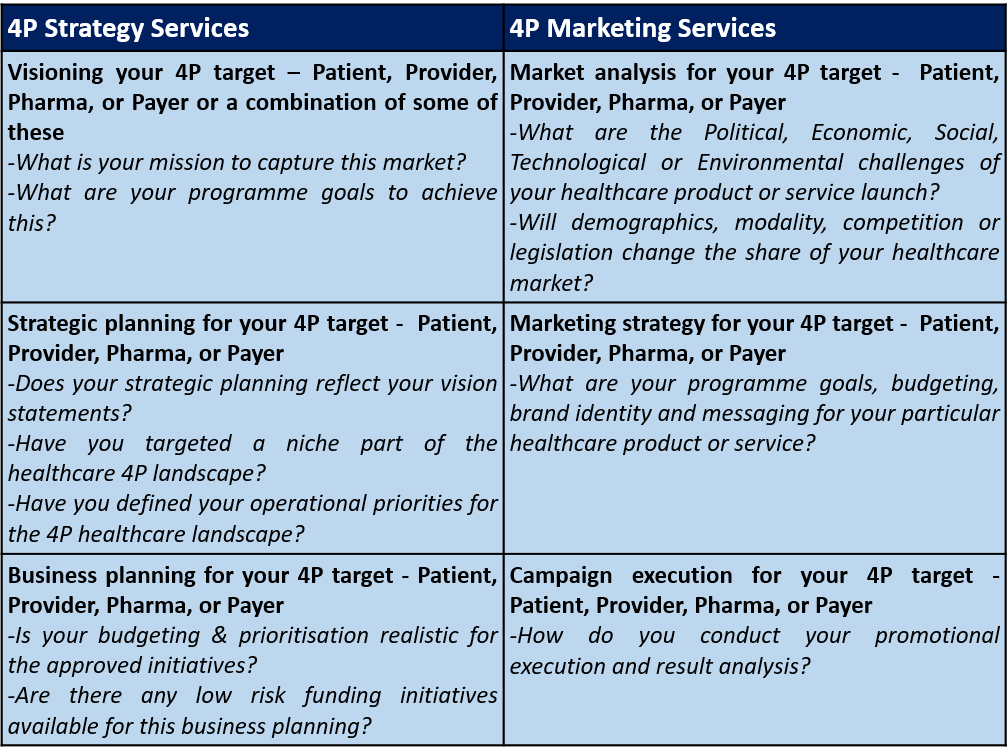

Strategic Marketing Services – Using Google Analytics and our in-house software analytics we can scrutinise and provide premium strategic marketing solutions at a very affordable price on any of the so-called “4Ps” sectors of the healthcare business space – Provider e.g. hospital, clinic or clinical trial site, Pharma e.g. pharmaceutical, biotechnology and life sciences entities who design and make new medicines, Payer e.g. insurance and government schemes which cover the costs of medicines and of course Patients, who have become the most important component in this patient centric market driven by healthcare outcomes. The table shown is an interview questionnaire grid which we use as a basis for formulating a cost-effective strategic marketing package for our clients and this plays a big factor in us acquiring repeat business for this service capability.

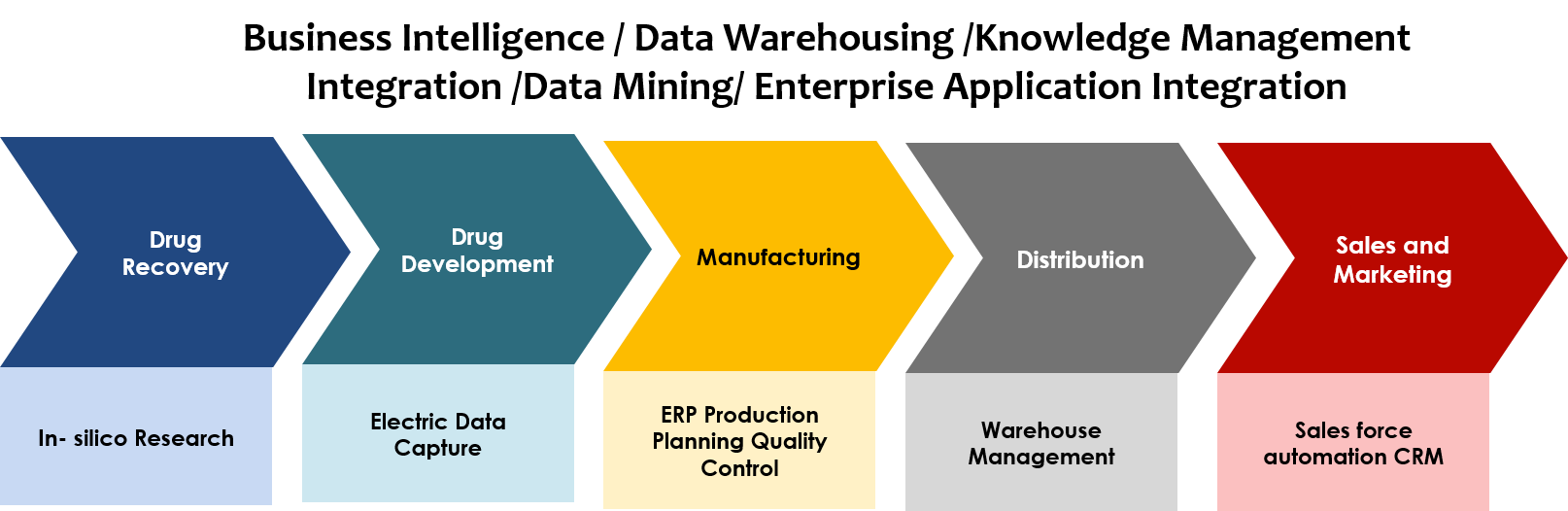

Value Chain Analysis – Once again we are capable of screening any of the 4Ps of the healthcare system – Provider, Pharma, Payer or Patient to identify a new chain of value whereby healthcare services’ value will provide the best treatment at the minimal cost. We can also identify key activities within your organisation (e.g. bulk material procurement for Pharma) and around (e.g. raising pharmaceutical sales levels via innovative web based interfaces for Provider) and identify them with the competitive strength of your healthcare product or service.

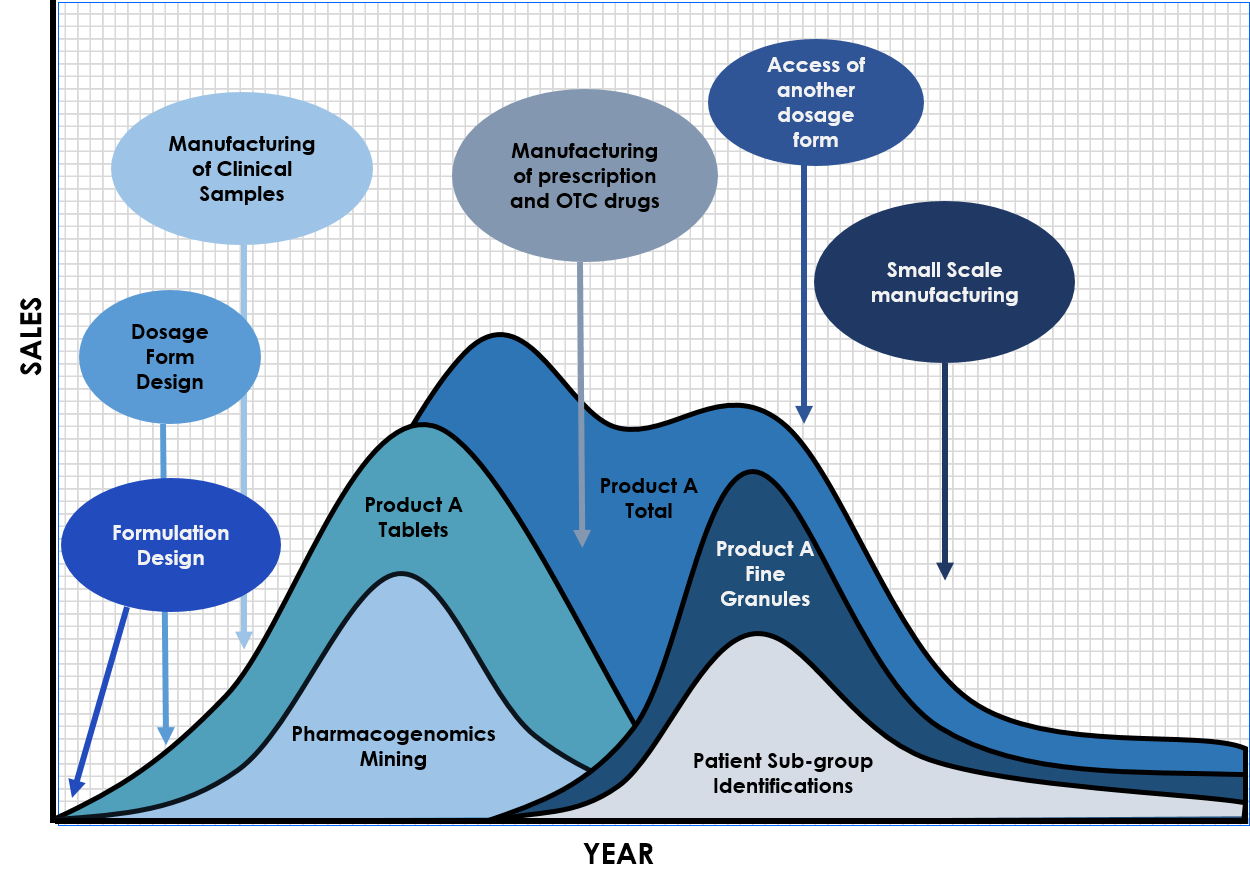

Life Cycle Analysis – Whether your launch has just gained regulatory approval or you’re seeking to extend an existing therapeutic line, we will assess whether your chosen market and operational strategy is appropriate given the stage of the medicine’s lifecycle. Your product may be either at the introductory stage i.e. just fresh on the market from regulatory approval, or at the growth stage i.e. enjoying a revenue surge from new patient awareness and buy-in, or at the mature stage i.e reaping the rewards of brand recognition and competitiveness over other therapeutic class medicines or finally at the decline stage i.e. has reached patent expiry with lower cost generics gaining ground and therefore we need to compare and give a critical appraisal of its market performance with those of competitors in the same therapeutic class and advise on the corrective action necessary.

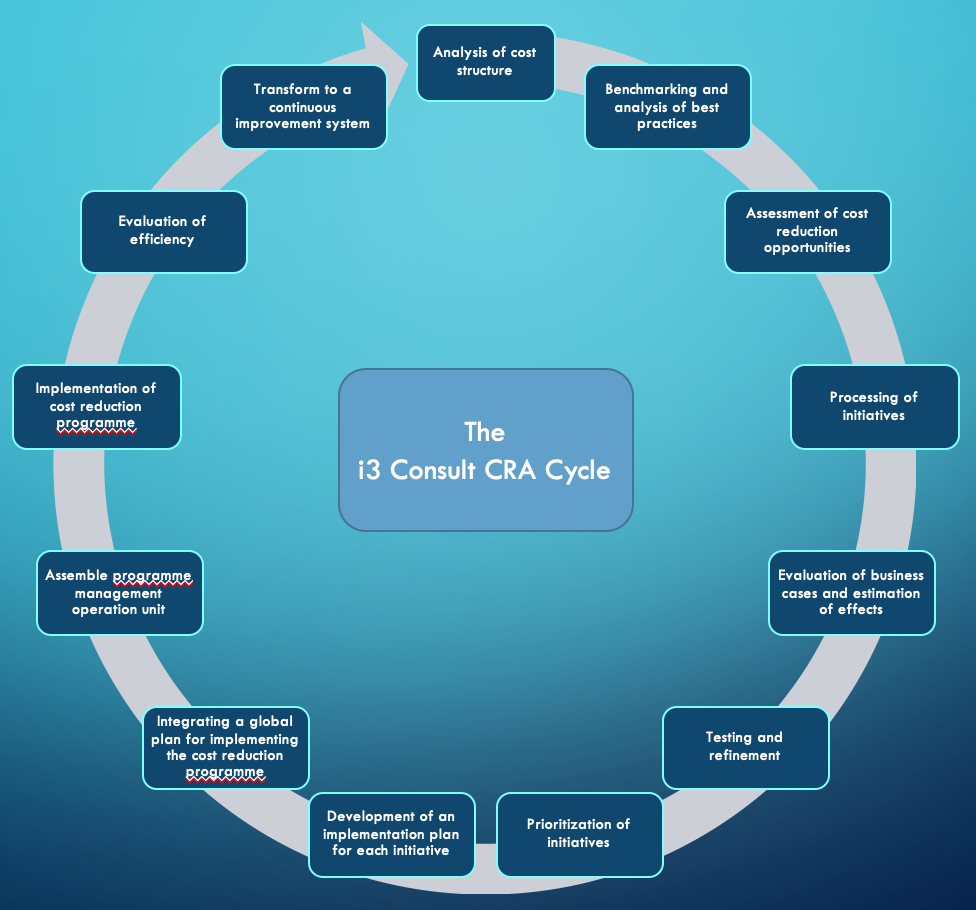

Cost Reduction Analysis (CRA) – The life sciences industry faces unrelenting new challenges. Different patient populations need to be treated with affordable medicines. While high research and development costs demand high productivity and reliability, the pharma sector must provide consistently high quality at lower cost. Maintaining profitability, global manufacturing and process affordability are success critical. Cost reduction solutions are more and more requested in this context. We work according to a proven formula of success using our CRA cycle.

i3 Framework Approach – Different countries have different pharmacoeconomic systems for evaluating the efficient use of healthcare resources, here we clarify the profitability of your chosen market through frameworks such as Porter’s Five Forces, McKinsey’s 7Ss, BCG Analysis, Strategic Clocking and other in-house models.

Financial Management Services – For this service we profile the financial position of your healthcare organisation by auditing investigational new drugs (INDs) in the pipeline, as well as scrutinising your annual financial reports to assess particular financial ratios, such as Current Asset Turnover Rates (Sales/Total Current Assets), Acid Test Ratios (Cash/Current Liabilities) & Capital Gearing Ratios (Debt Capital/Capital Interests) to harvest, hold, grow, turnaround or find niche with your current product or service portfolio. We can also give at a very affordable price an appraisal of your product and/or R&D investment portfolio in terms of Net Present Value and Internal Rate of Return.

R & D Manufacturing Consultancy – This is our niche consultancy service capable of providing Chemical Bulk Manufacturing solutions such as Inventory Control, Chain Management, Working Capital Issues, “Make or Buy” Decisions, Options for Batch, Combinatorial or Flow-line Processes.

CTR Reporting Services – As i3 Consult continues to offer its clinical trial reports (CTR) at www.i3consult.com/i3-clinical-trials-report/ on new drug therapies currently in clinical trials worldwide, we are seeking to use our CTR database as real world evidence in helping our clients to address the following critical success issues:

- Is the research sufficiently patient-focused?

- Have sufficient observational studies been used in the pre-approval and post market stages?

- Are there further opportunities for observational study data to save you time and money in your current clinical trial investigation?

- How observational studies can make a viable alternative to clinical trials or bridging studies.

- To identify stakeholders and determine what kind of observational research data is needed.