Analysing a Biotechnology Company for its Innovation, Strategy and Technological Value

At i3 Consult we have been successful in ensuring that a biotechnology client of ours retained a significant portion of funds upon initiating their highly successful IPO. Our client was a university based incubator company preparing for its IPO. In order to do this, they needed a comprehensive evaluation of the protein biomarker marketplace, including sales trends, competitive activity, client needs analysis and analogous case studies of competitors. i3 Consult provided a final valuation of investment funding, business angels and contingency VC funding. This begs the question, how was this possible? Below is outlined our approach to the project.

Our Approach

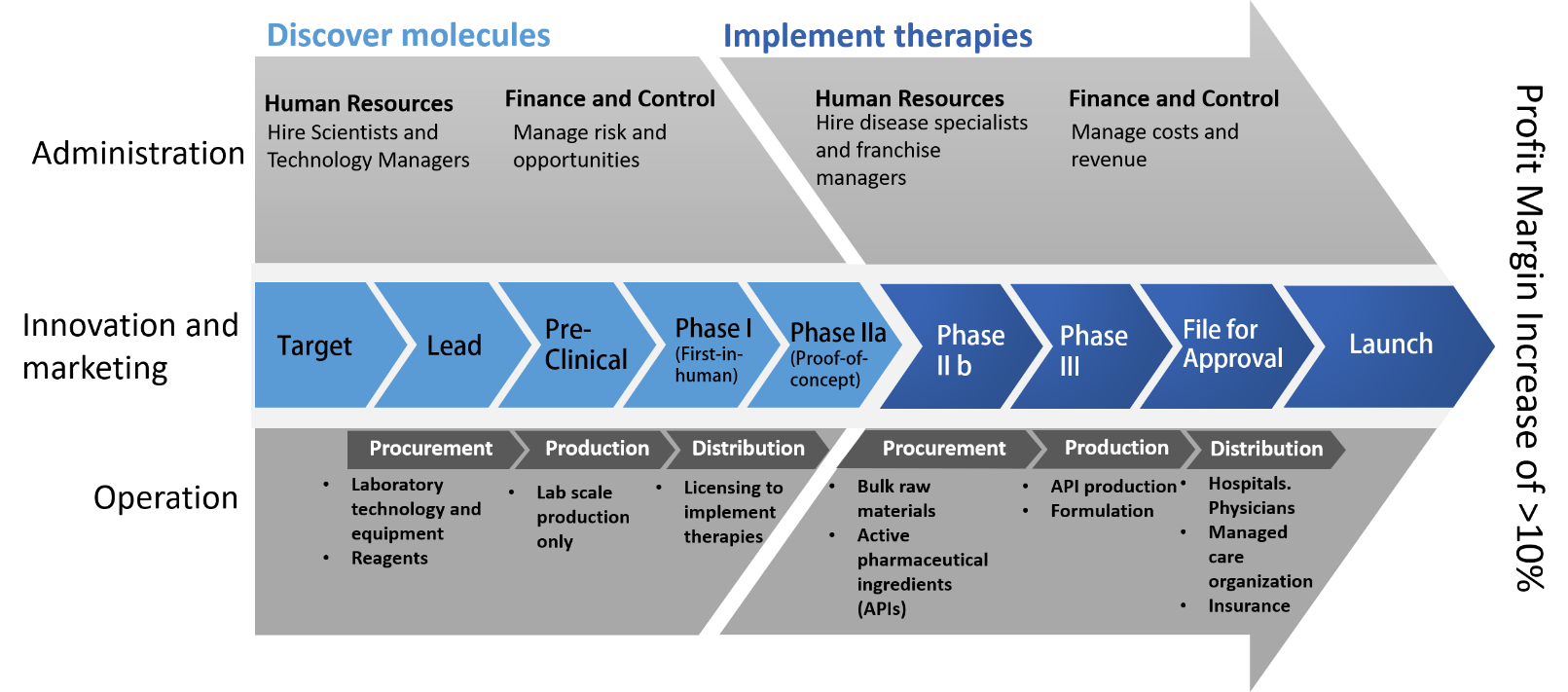

Focus groups/structured teleconference meetings consisting of 5 to 10 team members each from a cross-section of the Biotech company’s value chain were conducted to brainstorm on the critical success factors that will procure a greater market share. As a further refinement strategy, surveys of closed research instrument design tested attitudes and perceptions of the client’s current service offerings and clearly defined future ones to a selected pool of potential big pharma investors and licensing partners. The objective here was to confirm strategies for synchronizing the Biotech player’s value chain with the R&D pipeline needs of these investors. Full-scale value chain (Figure 1) and cost reduction analyses were conducted to clearly identify the organisational and operational transformations necessary for maximizing the profit margin. A full SWOT audit of the Biotech’s R&D, operational, technological and digital systems was conducted and reported for the client in a new business model road map.

(Source: A.T. Kearney analysis)

Figure 1: Biotech Value Chain Analysis